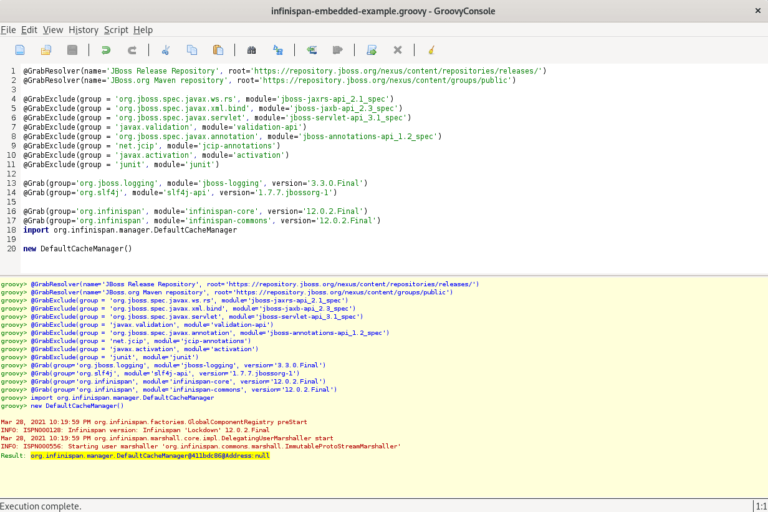

The following example demonstrates how the FRED Client API can be used to acquire data pertaining to the 10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity observations from the Federal Reserve Bank of St. Louis’ FRED economic research website:

Observations observations = queryBuilder

.series ()

.observations ()

.withSeriesId(“T10Y2Y“)

.doGetAsObservations ()

The call to doGetAsObservations performs a get on the following URI and converts the resultant XML into an instance of the FRED Client data model.

https://api.stlouisfed.org/fred/series/observations?api_key=[redacted]&series_id=T10Y2Y

The Observations returned contains a list of Observation instances which have date and value properties which are used to render the chart below.

See also:

[1] 10-Year Treasury Constant Maturity Minus 3-Month Treasury Constant Maturity (T10Y3M)

[2] 10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity (T10Y2Y)

[3] 2-Year Treasury Constant Maturity Rate (DGS2)

[4] Interest Rate Spreads

[5] Coherent Logic Enterprise Data Adapter